Contents:

Analyzing your financial reports is critical for any business, but especially in the restaurant industry. As you know, the margins in the restaurant industry are incredibly tight and there is no room for error. If you do find a cheaper option consider the time you will lose by having to manually use a different payroll provider. I guarantee you any minimal savings will be eaten up by your time, inefficiencies, and mistakes made by going external. If you do decide to use an external payroll provider I can’t recommend Gusto enough. In our experience, the integration between Square and QuickBooks Online does not work in the best way possible.

It has different types of fees depending on what type of payment you are accepting, how much time it takes for the transaction to go through, etc. Kashoois an accounting software that has an integration with Square. This means that when someone uses Kashoo they can automatically sync their transactions to their accounting software in real-time. Square is a merchant that provides merchants with credit card processing and POS services. Square Bookkeeping also offers additional services to support small businesses & sole traders through the entire business process. We want to assist you in making life simpler and ensuring that you concentate on what you enjoy doing best, making your business successful.

My advice is that you need the cash deposits made into the bank to match the Square sales reports cash received line item. Some owners prefer to deposit each day’s sales as an individual deposit into the bank and that works fine. Others will group several days of cash deposits into one large deposit and that also works fine. Square has made accepting credit card payments easier than ever before.

I would gladly reconsider my actions if Squareup.com makes inroads into supporting this yet untapped customer base. It allows users to easily accept payments from the card reader at the point of sale. It also makes it possible for businesses to use credit card processing without any fees. If you use Square to run your business, integrating it with Xero will eliminate tedious tasks and speed up your efficiency on back-end tasks. Square helps businesses of all sizes with payment acceptance.

Learn how Square bookkeeping automation can save you time and provide better data

If you have to ever dive into the details of a ticket that is the whole point of having a POS system like Square. I’ve merged your post to an existing thread where other Square Sellers have asked the same question regarding integration with Quicken. At this time, we do not have any further information on whether or not integration with Quicken is in our future. Kashoo has customizable templates with an intuitive invoicing tool. They also allow you to set up automations and reminders with email.

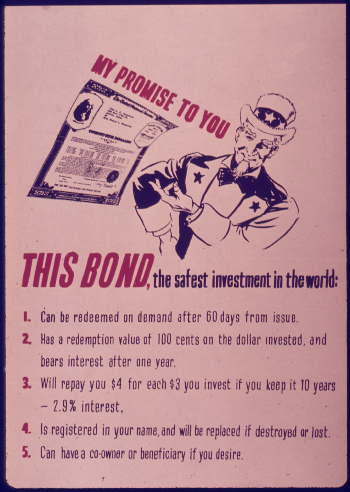

The W. W. II “Operation Camouflage” That Enlisted Hollywood – Air Mail

The W. W. II “Operation Camouflage” That Enlisted Hollywood.

Posted: Sat, 22 Apr 2023 02:03:17 GMT [source]

Connect to Square adds details to QuickBooks when an order is closed on the same day that the final payment is received. QuickBooks will then adjust out that prior payment when the order is closed on the day the final payment is received and the sales details are added to QuickBooks. Connect to Square can only match the exact names of your customers. For example, if you record your Square transaction as FirstName LastName, but in your QuickBooks it is LastName FirstName, the app will not match the customer. However, once you manually point an imported transaction to the correct QuickBooks customer, the app automatically updates to the correct customer in the future. If you haven’t already, connect the bank account Square uses to deposit money from your sales.

About cookies | Manage cookies

That way you simply capture those expenses through the QuickBooks Online bank feeds and code accordingly as they hit your bank or credit card accounts. Each of these platforms makes it easy for small businesses to manage their finances with Square, which is why they offer features like automatic transaction tracking and cloud access. Square and the integration of accounting software help small businesses to avoid costly mistakes that can lose time or money.

We recommend Kashoo because it is simple and easy to learn. By using an accounting software with Square, you can manage the billing aspect in one platform while collecting or sending payments with Square. Square does not provide the same advanced tax management features as some of the online tools like QuickBooks, Xero, or Kashoo. This makes it even more important to rely on more than one platform to run your business. These tools are customizable and built with small businesses in mind. The software has a lot of features that make it easy for businesses to track expenses and automate processes while also handling the paperwork seamlessly.

Square vs. QuickBooks: Head-to-head comparison

Make managing shifts a breeze and track sales per employee to inform how you schedule. Basic bookkeeping is also the minimum threshold for qualifying for loans, grants, and federal programs such as the Paycheck Protection Program . All of these require that your company’s bookkeeping is both accurate and up to date. Manage all of your clients in one place while receiving daily, individual status reports. “Daily and accurate journal entries mean I know where my business stands every day without a lot of checking or calculating between different programs.

The free version classified balance sheets all the features you need to get your finances in order, including expense and mileage tracking, reconciliation, invoices and email support. One of its best features is that it can integrate with other Zoho products, such as Zoho CRM, making it a good choice if you’re already using other Zoho software for your business. If your small business has less than five employees, you can use the free version of NCH for your accounting software.

GnuCash is a good option that’s compatible with Linux, as well as Windows, BSD, Solaris and Mac. It includes features, such as bank account tracking, expense tracking, financial calculations and reports. While it doesn’t have as many extras with its small business features, it makes up for it in flexibility, with the ability to track stocks, commodities and other investments. Paid plans start at $15 per month, billed annually, and offer features that include multiple users, bulk updates, timesheets and sales tax tracking. Learn more about what Zoho has to offer with our Zoho Books review. AccountingSuite™ is a powerful cloud-based accounting and business management software that offers unlimited user access.

Manage order history and customer notes, book recurring appointments, and offer loyalty programs via email or SMS. Manage order history and customer notes, book recurring appointments, and offer tempting loyalty programs via email or SMS. Technology has brought us many ways to communicate across a business.

- For over a decade, she’s helped small business owners make money online.

- Consider putting written standards in place for company expenses and personal expenses.

- Unfortunately, at this time, Square doesn’t work with Quicken, but there are some great alternatives.

- You can review and edit the information before you add them to your books when you’re ready.

Our connected tools are built to scale with future-focused, connected tools. Enhanced, customer-friendly experiences help build deeper data and better customer relationships. And our open platform means you can connect to prebuilt integrations or build out your own with our APIs. Learn how Square works with larger, more complex businesses. Pick what you need so time-tracking, reservations, inventory, and delivery apps all work in sync. Create a memorable experience whether your customers dine in person, order delivery, or buy a gift card online.

As you go through your financial reporting think about it as an internal audit on both yourself and your accountant. It’s ok to be confused or to say that something just doesn’t look right. If the numbers don’t feel right to you chances are there is an error that needs to be resolved.

AccountingSuite™ software is an amazing inventory control tool within our organization, this platform has greatly helped in controlling all accounting data within one place. Yes, one of the great advantages of using AccountingSuite™ is the flexibility we offer when it comes to choosing and changing your pricing plan. AccountingSuite™ understands that businesses have changing needs, and as such, we have made it easy for you to upgrade, downgrade, or switch plans at any time. The app doesn’t import “money out” transactions from a Square Card.

To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. The AccountingSuite™ application runs in a highly secured data center located in the United States. Our data is backed up every 15 minutes to another equally secure data center in a physically different location which helps to ensures that you never lose your data. The Easy to Use Workflow is designed to simplify and streamline processes, making it easier for users to complete tasks and achieve their goals. This workflow is intuitive and user-friendly, minimizing the learning curve and allowing users to quickly become productive.

- Here you’ll also find advanced settings, and where to go to disconnect the app.

- Select the tab for the type of setting you want to change.

- Square doesn’t currently have a direct partnership with Quicken.

- Examples of financial statements you can generate include income statements, balance sheets, profit and loss (P&L) statements and sales analysis by item, customer and salesperson.

- It also has a mobile app that allows users to access their finances from anywhere.

The best accounting software that work with Square are Kashoo, Xero, and QuickBooks. They will integrate seamlessly and avoid disrupting your business processes already in place. Business software is essential for continued business success, for small businesses and enterprises. There are a number of different applications that go into how a business runs, how employees are paid, how to process payments, accounting and more. Accounting is one area that, when done right, will pay for itself many times over. For example, deciding on the right business structure can be tricky and subjective and come with big tax implications.

Republicans defend Trump by attacking criminal justice system – Arab News

Republicans defend Trump by attacking criminal justice system.

Posted: Sat, 01 Apr 2023 20:57:54 GMT [source]

QuickBooks can then download your bank transactions and match them to your Square transactions. For most restaurants, we recommend using QuickBooks Online for your bookkeeping software. QuickBooks Online is a great cloud-based accounting system that has the ability to integrate with many applications and software to automate many tasks and create efficiencies. The best accounting software for Square is one that meets the needs of their customers, like accounting software that integrates seamlessly to make it easier to use.

Because I’m not spending so much time on worrying about making schedules, doing payroll, or updating with inventory. And that really helps with paying back your loans because you’re not using your outside money, you’re using money you just acquired. Or hear what our customers have to say about Square on our review page. Get the full picture of your salon or spa with detailed inventory, sales, and team performance reports — all in one Dashboard.

To ensure that the system is secure and sensitive information is protected, AccountingSuite™ has developed an extensive user privileges and roles management system. This system is designed to allow administrators to create customized roles for each user, based on their job function, department, and level of responsibility. No, one of the key benefits of using AccountingSuite™ is that there are no obligations or contracts involved. This means that you can start using the software without any commitment and explore its features to see if it’s the right fit for your business.